Don't know how to record depreciation in Quickbooks then give a quick call on our toll free number:- 1877-249-9444

Know how to record depreciation in quickbooks by our expert

To set up an advantage account:

Pick Gear Icon > Chart of Accounts.

On the upper right snap New.

Under the class, type select either Fixed Asset or Other Asset*.

Select the detail sort of benefit (if none relate select the nearest and continue) and afterward click Next.

Name the record.

For the inquiry: Do you need to track the devaluation of this benefit?, click Yes or No. (In the event that Yes is chosen the framework will naturally make a Depreciation subaccount for the thing) how to record depreciation in Quickbooks.

Fill in the first cost fields. (In the case of recording the advance, please leave this clear.)

Snap Finish. either you can call for help toll-free number 1877-249-9444.

* Consult with your bookkeeper on what to choose. Just certain kinds of benefits will cause the deterioration question to populate.

The accompanying directions are just the nuts and bolts on the best way to set up advances for resources. When making a buy there are constantly numerous different things that must be mulled over, for example, exchange, upfront installment, expenses, assessments, et cetera. You have to counsel with your bookkeeper to examine how to represent these factors.

To deal with a credit to buy another advantage (auto, truck, and so forth.) you'll have to set up an obligation account. On the off chance that you were purchasing a truck, for instance, you may call it "Credit - Truck." Depending on the reimbursement time period, pick either Current Liability (to be forked over the required funds inside one year) or Long-term Liability (to be reimbursed over one year).

To set up this record:

Pick Gear Icon > Chart of Accounts.

On the upper right snap New.

Select either Other Current Liabilities or Long-term Liability (contingent upon the length of credit).

Select the detail kind of Other Current risk or Long-term obligation (a depiction is leaned to one side of every choice) and snap Next.

Name the record.

Leave the Unpaid Balance clear.

Snap Save.

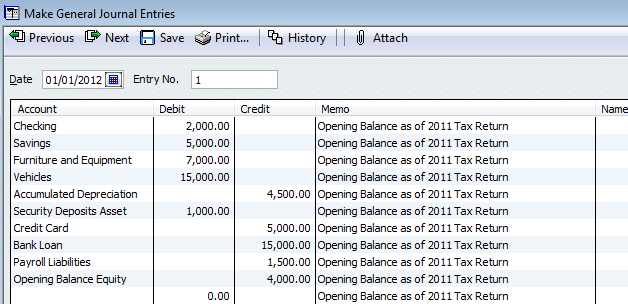

Since you have this setup, you'll have to make a Journal Entry to record the measurements of the advance to the best possible records.

Pick Plus Sign (+) > Journal Entry.

For the main line under the Account section, select the new risk account.

To one side of the risk account under the Credit, segment enters the measure of the advance.

For the second line under the Account segment, select the proper resource account.

To one side of the benefit account under the Debit, section enters the measure of the credit.

Here's a case:

- Loan - Truck (risk account) - $ XXXX.XX (Credit)

- Truck (resource account) - $ XXXX.XX (Debit)

When you make a diary section, the credits and charges must equivalent zero. In the above illustration, we are expanding, or crediting, the obligation/advance record and expanding, or charging, the fitting resource account.

To pay and amortize the obligation of an impalpable resource, please observe Does QuickBooks Online have an amortization plan?

To record the installment of your credit:

Pick the financial balance you use to make installment.

In the event that you intend to print this check from QuickBooks Online, snap to stamp the alternative To be printed.

To Choose a Payee to select your loan boss.

In the event that this is a written by hand check/check enter the Check/Check # and fitting Date.

Under Amount, list everything of the installment (main + intrigue).

On the off chance that you need to track both important and intrigue, you have to list two records in the Account area beneath the check. One line is for the advance risk account where you would enter the aggregate key paid as the Amount.

The second line is for the intrigue cost account (in the event that one isn't yet set up observing the accompanying advances) and the relating Amount of intrigue paid.

Note: The sum on your check must equivalent the aggregate of the lines posting chief and intrigue. For particular data on what records ought to be utilized, counsel your bookkeeper or accountant.

Snap Save or Save and Print.

To set up an intrigue cost account:

Enter a name in the record section beneath the check, for example, "Intrigue Paid for Loan" and press enter.

Cost ought to be pre-chosen; click Next.

Select Interest Paid and click Next.

Snap Finish.

QuickBooks Online does not naturally deteriorate settled resources; rather, it's a manual procedure utilizing diary sections. U.S. clients might need to counsel the IRS production on the theme of deterioration in case you will attempt this yourself:

Note: You can make this procedure more robotized by setting up particular diary sections on a period plan utilizing Recurring Transactions.

To devalue an advantage:

In the first place, set up a devaluation cost account (if not as of now made):

Pick Gear Icon > Chart of Accounts.

On the upper right snap New.

Select Other cost and snap Next.

Select Depreciation and snap Next.

Enter the coveted name, for example, Asset Loan Depreciation Expense and snap Finish.

Toward the finish of the year when you or your bookkeeper have computed the devaluation sum, enter the exchange:

Go to the Plus Sign (+) > Journal Entry.

In the primary line:

For Account, select your deterioration cost account.

Under Debit, list the measurements of the deterioration.

On the second line:

For Account, select the benefit account you are Depreciating.

Under Credit, list the measure of deterioration.

Snap Save.

Really very beneficial tips are provided here and, Thank you so much. If you interested for Online betting

ReplyDelete