1877-249-9444 how to record depreciation in Quickbooks | Quickbooks tech support :+18772499444

How to record depreciation in Quickbooks

At the point when your business pays for something that speaks to a misfortune in esteem after some time of at least one settled resources — resources that you don;t change over into money amid ordinary tasks — you should record it as a devaluation. Things like hardware, furniture, office supplies, and so forth are altogether deteriorated costs. While the procedure of may sound befuddling, Quickbooks makes recording such costs a breeze. For a well ordered walkthrough on the best way to record a deterioration in Quickbooks, continue perusing.

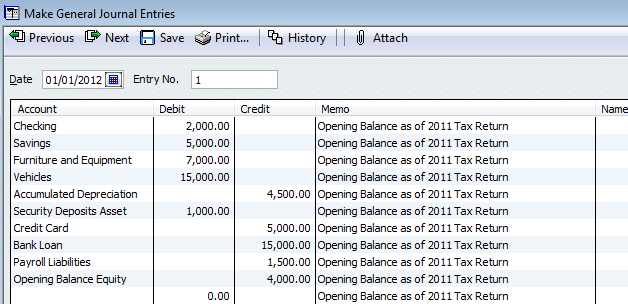

Before we start, it's essential to take note of that each settled resource in Quickbooks ought to be given its own parent resource account, which is found in the diagram of records, alongside two subaccounts. The main subaccount is utilized at the first buy cost of the separate thing or cost, while the second subaccount is utilized for the collected deterioration.

To make a settled resource account in Quickbooks, sign into your Quickbooks record and access Lists > Chart of Accounts

> Account

>New. From here, pick Fixed Asset

> Continue

> enter a name for the new settled resource record and snap "Spare and New."

Next, pick the subaccount of starting from the drop menu, trailed by choosing the parent organization account. You will then need to click "Enter Opening Balance," and soon thereafter you can enter the buy date in the "as of" field, trailed by OK. When you are done, click Save and New.

To record a devaluation, essentially get to the

Lists menu how to record depreciation in Quickbooks

> Chart of Accounts

> double tap the benefit's Depreciation subaccount

> enter the separate date in the date field

>enter the deterioration sum in the Decrease segment

> select the devaluation cost from the Account drop-down menu

> and click Record. Congrats, you've recently recorded a devaluation in Quickbook!

Remember that after you have recorded the devaluation for a settled resource, your graph of records will demonstrate the benefit's new an incentive in the parent resource account. This implies when the benefit's lifetime reaches an end, the parent resource's subaccount will be equivalent. Besides, the estimation of the parent resource record will return to zero. As indicated by Intuit's own particular site, the adjust in your benefit record will exchange over from year to year, with cost accounts being reset to zero toward the beginning of another year.

Comments

Post a Comment